Forest Permanence and Voluntary Carbon Markets

The wide range of prices found within the voluntary carbon market (VCM) has been the subject of much discussion among analysts and observers.

There are many factors at play, both on the supply side and on the buyer side. It is important to remember that the voluntary market represents a small, rapidly evolving segment within a much bigger pool of climate finance flowing through regulated markets such as the EU ETS, mainstream investments in renewable energy and government funding of various types.

A major clue to the diversity of pricing within the VCM is found in the term Voluntary – i.e., participation by buyers and choice of projects and technologies delivering credits are discretionary, not subject to regulation. The motives of voluntary buyers are diverse – ranging from those who are just seeking a convenient and affordable way to address the climate impacts of business activities, to those who want to forge a reputation or brand identity associated with specific technologies such as direct air capture or nature and human based solutions.

VCMs covers a broad set of buyers and sellers with varied motivations

Carbon Market Standards & Verification

On the supply side, minimum viable pricing is determined by the technology itself plus the verification processes demanded by the standards used to bring credits to market. A big motivation for project developers using the VCM is to access capital where other forms of investment, grant aid or other sources of finance have failed to deliver. So, an important feature of the VCM is that it fills gaps in existing policies, programmes and capital markets. In effect, the additionality required by standards to demonstrate projects are making a genuine difference is a reflection of gaps in climate policies and the lack of carbon pricing in the mainstream markets.

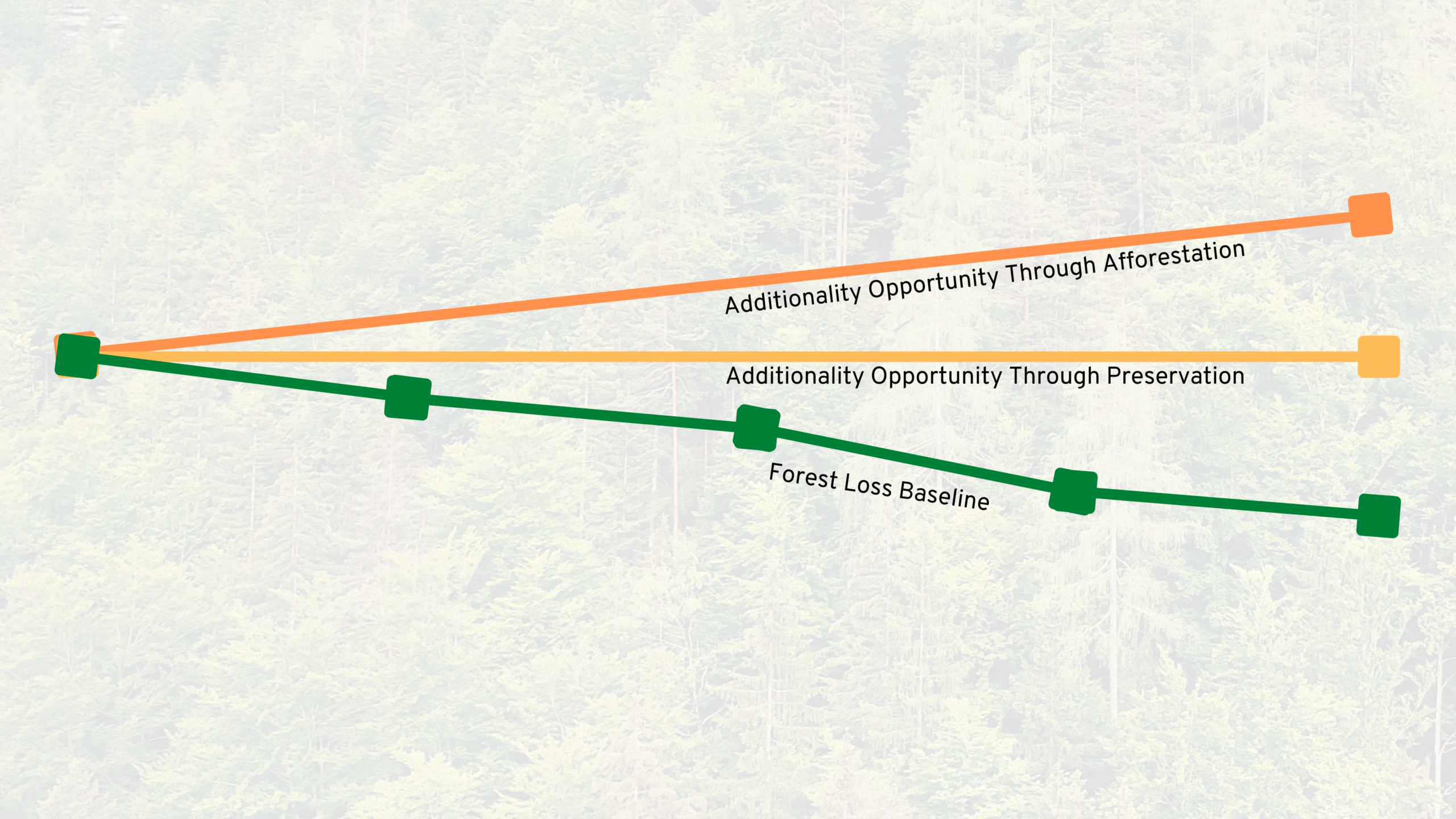

Forest Permanence and Additionality

Additionality defines the opportunity against a baseline to effect positive change in carbon capture potential. The delta in carbon capture potential can be expressed as an opportunity denominated in Carbon Credits

Financing, whether through the purchase of carbon offset credits or flows of international climate finance, is frequently (and rightly) questioned on the basis – What if the forest we protect or restore is lost or degraded within five, ten or fifty years?

Alongside buyer motivation and additionality, we have found the permanence or durability of carbon stored by removal or emission avoidance projects to be a major influence on pricing.

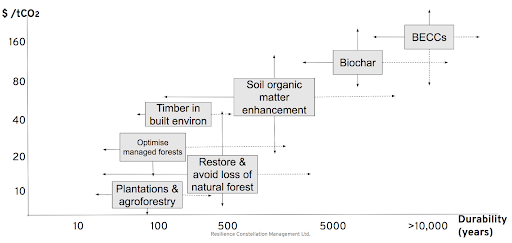

Research by Beatrice Mocci and others at the University of Edinburgh found a strong positive relationship between the expected durability of carbon storage and the price of resulting credits. Mocci and others identified three main price – permanence bands:

- Forestry systems, with decadal to century levels of permanence in a $5 to $50 /tCO2 price band

- Soils, biochar and solid timber, with century to millenia durability in a $50 to $200 /tCO2 price band

- Geological and deep ocean storage with millenia to billenia durability in a $300 to $3000 /tCO2 band

Our own examination of the viability costs of different carbon management options in relation to durability has indicated a similar positive relationship, as shown here:

Costs of delivering different levels of permanence through different types of biological carbon management.

Initiatives to increase confidence in the VCM are just starting to grapple with the question of permanence (or the risk of non-permanence), with current practice focused on the use of risk buffers.

A risk buffer is a stock of credits that a project must keep unsold in reserve to cover the risk of losses within an agreed timeframe; typical project risk buffers are between 5% and 20% but there is a limited science behind this range and few standards are actively monitoring risk buffers to check their adequacy.

Enter The Forest Carbon Ratings

A new information product by Resilience Constellation – the Forest Carbon Rating (FCR) provides information on forest carbon storage and the level of risk buffer likely to be needed to provide security against the risk of losses. This is a familiar application to ratings of bonds and other financial instruments – indicating the probability of default.

FCR metrics can be applied to inform pricing and risk buffers along the following lines:

Rating v Risk Buffers

- AAA – project / jurisdiction justifies a minimum level of risk buffer

- BBB – project / jurisdiction should have a mid-level of risk buffer specified by standard

- CCC – project / jurisdiction requires a high level of risk buffer and corrective actions

- DDD – Risk buffer inadequate, urgent action needed to secure avoided emissions and carbon stocks

Rating v Indicative Credit Price

- AAA – consistent with high end of range prices (>$20 /tCO2)

- DDD – consider as “junk” status, low end of prices (<$5 /tCO2)

Ratings and investments in credits

The FCR provides a basis to allow portfolios of credits to be acquired with a view to increasing their value over time. For example: a developer acquires credits from C rated jurisdiction and invests in improving forest governance and protection from C to A, thus raising the value of credits held as assets.

We believe the FCR product can be used to drive significantly better informed decisions and through this drive value to those financing projects.